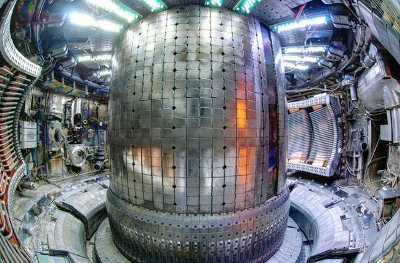

Following up on our previous post ‘How Private Initiatives to Reach the Graal of Nuclear Fusion Show a Tipping Point in the Financing of Fundamental Science‘ that expanded on TAE technologies (a US West Coast startup close to Stanford), another similar start-up – this time on the US East Coast close to the MIT – Commonwealth Fusion Systems, has also recently raised dozen million dollars for the same goal, using a different technology (see here the Wikipedia entry on Commonwealth Fusion Systems).

In the same year where the US is gone back to space thanks to private companies such as Space X, with an alliance of high technology and design, this really raises the question of the future role of governments in running fundamental scientific experiments and high technology programs by themselves. The aspect which I want to expand here is actual execution of advanced science and technology leveraging on competition.

Both the new space programme and the new fusion efforts appear to share the same principle of competition (Space X, Boeing and other ventures competing for the NASA contract, several companies competing for fusion) . Where in the past large science experiments were run in monopoly fashion (NASA space program, or ITER in fusion), the new world of abundance of private funding (and increased scarcity of public funding) allows to run these high-risk programs with several teams in competition. This is probably an excellent thing to reach the goal quicker and with better quality: a spirit of competition, the emergence of a variety of ideas and solutions, everything that innovative programs should seek (and have sought, as in the famous parallel development of uranium-based and plutonium-based solutions during the Manhattan nuclear project).

I believe this is a fundamental shift in how science is getting done, and not sufficiently noticed. Monolithic state research organisations need to get into this new world of competitive fundamental research, fostering initiatives instead of trying to capture them and run them by themselves.