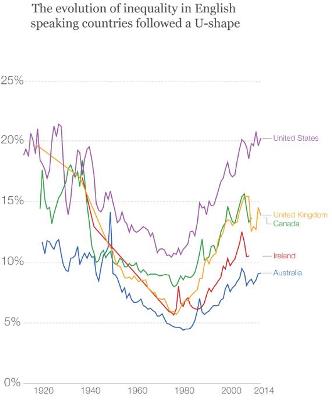

Still following up from our previous post ‘How the Current Asset Over-valuation Changes Economic Behavior‘, and referring to the research paper ‘Bubble or nothing‘, the increase in the relative value of assets is also a good explanation for the increase in social inequality: those who have assets see their wealth increase substantially (doing nothing) compared to those who don’t. And it becomes harder for those who don’t have assets to acquire them.

This however comes with a pinch: if most of the increase in wealth of the the richer is based more on asset value than on actual direct income, any economic shock that would decrease substantially asset values would also reduce a large part of this apparent inequality.

On the other hand if the relative increase in asset value is a deeper, longer term trend linked with the Fourth Revolution (see our post ‘How the Increase of Asset Values Could be Linked to the Fourth Revolution Transformation‘), then we should expect this effect to be permanent and even increase in the foreseeable future. Access to ownership of assets will then become a major issue to address inequality (including property, as the family house is the prime asset for most people).

There are deep, multi-decade trends pervading our economy and traditional economic studies may not sufficiently understand them. It seems like the Collaborative Age will require quite a different approach to the economy, and probably to taxation and redistribution.