Following up from our previous post ‘How the Current Asset Over-valuation Changes Economic Behavior‘, the question is open whether this historical trend about historically extremely high asset prices and always lower interest rates since the 1980s (the Era of Big Balance Sheets) is a temporary situation, or if it could be representative of a shift created by the Fourth Revolution (a shift to the virtual, global economy).

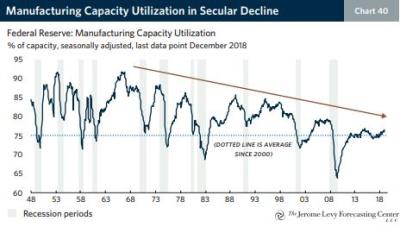

In the research paper ‘Bubble or nothing‘, the enclosed graph and a few others remind us that there is currently overcapacity in terms of assets compared to the production capacity (this observation seems to apply to manufacturing as well as to offices or any class of asset supporting value production). This can be explained partly by the high value of assets but also by the fact that actual physical production does not increase any more and is disconnected from overall economic growth: the economy becomes increasingly virtual with the Fourth Revolution.

One of the reasons behind asset relative value increase could thus be that value being created virtually in the new economy drives up the value of the physical assets, which are in limited quantity. Therefore, an interpretation of the current overvaluation of assets could be the virtualisation and increased productivity of the Collaborative Age economy. This would be a bit similar to the Baumol effect explaining the relative increase in cost of less productive areas of the economy such as healthcare (see our post ‘How the Relative Increase of Cost for Education or Health Care Can be Explained‘). If that is the case, then we should not expect asset valuations to drop off anytime soon (independently from temporary recessions and readjustments).

I would be quite interested to see whether there has been some economic studies about the impact of the virtual economy on asset valuation. Please contact me if you know of any such study.