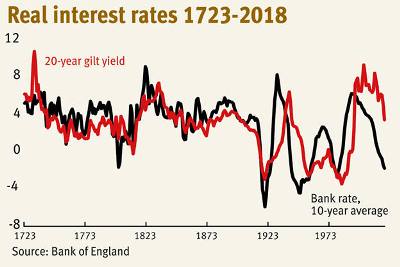

As you may have noticed I love to put things in historical perspective. This excellent Daily Reckoning post ‘5,000 Years of Interest Rates‘ just shows how the current situation is not new. It even quotes statements from the late 19th century that expressed despair at the low real interest rates of the time.

There is even more: it would appear that the historical trend would be towards lower real interest rates: “Despite temporary stabilizations such as the period between 1550–1640, 1820–1850 or in fact 1950–1980 — global real rates have shown a persistent downward trend over the past five centuries… This downward trend has persisted throughout the historical gold, silver, mixed bullion and fiat monetary regimes… and long preceded the emergence of modern central banks.”

There is a view thus that interest rates should continue to fall down unless another period of exceptional economic expansion kicks-in again (which could be still be possible with the reach of the Collaborative Age).

Historical perspectives are always inspiring. Of course the future is never quite the extrapolation of the past, but one can only observe this ongoing trend towards lower interest rates, that may also be the consequence of more available capital globally.