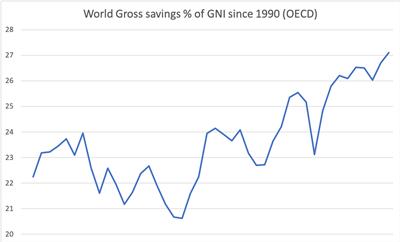

We are currently in a situation of excess savings in developed countries and therefore unprecedented availability of private funds for all sorts of new ventures including the most risky innovations and fundamental research projects (for example see our post ‘How Fundamental Scientific and Technological Programs are Now Run in a Competitive Manner by Private Companies‘). This excellent post ‘The Global Savings Glut, a Modern Policy Failure‘ gives a useful explanation of this situation which pervades our economic system and has accelerated since the 2008 crisis.

“We are operating in a world where there is a massive excess of capital vs. productive places to put it. Which is why valuations on high quality assets able to absorb this savings is so high.” And thus, when there is some start-up that looks like it could become high quality, it instantly attracts capital.

The analysis is that while China became the manufacturing center of the world, it did not let its currency appreciate, and started generate high levels of local positives as well. With goods becoming ever cheaper, savings capability increased in developed countries. “Globalization ended in 2011 and no one adjusted. Export based policy and high savings rates reinforced each other even as globalization forces weakened starting in 2011.” And of course, the constant policy of very low interest rates. With “the amount of savings in Asia and Europe far bigger than the size of their domestic asset markets“, the money pours into the US markets, killing in the process all sorts of possible US monetary policy.

It seems that with the pandemics the current trend will rather accelerate with ever cheaper money being poured to the economy. This can only increase the savings glut, make valuable assets more expensive, but also continue to foster private capital being poured into all sorts of fundamental initiatives that were previously performed by governments.