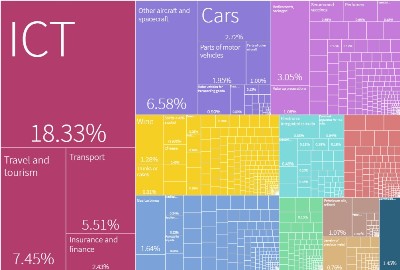

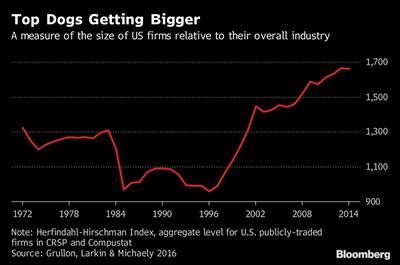

In this interesting post ‘Superstar firms and market concentration‘ the economist Tyler Cowen quotes a paper that rebuts the notion that market concentration is rising because of inadequate antitrust concentration. The thesis is that super companies arise because of the collaborative age: global market availability, communication capabilities.

“If globalization or technological changes push sales towards the most productive firms in each industry, product market concentration will rise as industries become increasingly dominated by superstar firms, which have high markups and a low labor share of value-added.”

The authors then make a number of predictions including that the pattern should be visible internationally, and that superstar concentrated firms will be where productivity increases most.

Still, the Fourth Revolution has created a concentration that needs to be regulated somehow. But we may underestimate the value of the possible scaling effect brought by modern communication capabilities.