This excellent NewYorker article ‘How Venture Capitalists Are Deforming Capitalism‘ reinforces the fact that Venture Capitalism can have some really bad sides. The point made here is that they can pour so much money in a specific venture that it inflates it, dominating the market, while not being sustainable, crushing other more sustainable alternatives in the process.

The article develops particularly the case of WeWork and how it crushed the market of co-working spaces thanks to an almost unlimited access to capital, therefore allowing the company to buy premium space and rent it out very cheaply. Competitors could not follow suit: “No one could make money at these prices. But they kept lowering them so that they were cheaper than everyone else. It was like they had a bottomless bank account that made it impossible for anyone else to survive“.

The problem here is that there is an assumption that if you capture quickly the entire market, then you can become very profitable. The public promise is that you will generate sufficient scale- and network-efficiency to create extreme value that will benefit everyone; the nasty and less publicized side of it is that if you crush competition you can exploit a monopoly situation and increase prices in the future. There is a fine line between both situations and it is not always obvious which side is really sought by large, well funded start-ups.

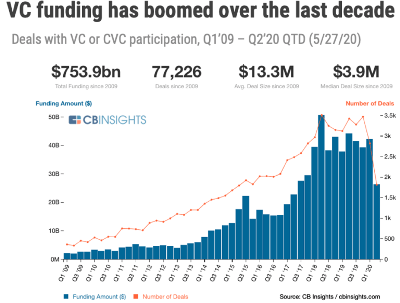

The article is quite pessimistic: “The V.C. industry has grown exponentially since Perkins’s heyday, but it has also become increasingly avaricious and cynical. It is now dominated by a few dozen firms, which, collectively, control hundreds of billions of dollars.” Bets have increased on certain ventures, with overall limited return on capital invested. There is less personal commitment.

“A 2018 paper co-written by Martin Kenney, a professor at the University of California, Davis, argued that, thanks to the prodigious bets made by today’s V.C.s, “money-losing firms can continue operating and undercutting incumbents for far longer than previously.” In the traditional capitalist model, the most efficient and capable company succeeds; in the new model, the company with the most funding wins. Such firms are often “destroying economic value”—that is, undermining sound rivals—and creating “disruption without social benefit.””

In a world where funds are more and more readily available due to low interest rates, there may be a need to regulate excessive investments in new ventures that have poor governance and unrealistic expectations. In any case one should be wary of not finding oneself in an impossible competition with an excessively funded start-up.

For more thoughts about the limits of Venture Capital, read my previous post ‘How Venture Capitalists Don’t Really Play the Role We Believe‘