In a short series of posts I want to share some thoughts from my experience as a Business Angel with now about 15 investments over the last 5 years, and review of 100s of start-up pitches per year. The first aspect I want to tackle is company valuation. Valuation for a start-up at early stage is guesswork, but my point is that often the valuations proposed are difficult to justify with a reasonable business plan. They are too high and thus make it difficult for the business angel to get proper value for his money taking into account the risk involved.

As a caveat, the start-ups I invest in are usually in the physical world, aiming to produce products or services in support of industrial production. In this context, exponential growth may happen but scaling can be expected to be slower.

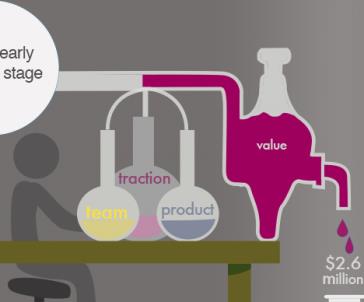

Valuations are often a guesswork by founders, based on the share they accept to leave to investors, how much time they invested, their own ego and only sometimes business plan considerations. I often see excessive valuations for early start-ups with barely a workable Proof of Concept and no or very limited market feedback (in this I mean actually having sold something to a client – free trials don’t count).

The number founders arrive to is often dictated by the fact they don’t want to be too diluted, but if they want to raise serious money and give out only 10% of their capital, the resulting valuation will be very difficult to actually reach within the 5-7 years of investor commitment – and sometimes even when the company will reach its first development stage.

My experiences makes me increasingly weary about early stage valuation. Founders need to be reasonable even if this means a bit more dilution – they can’t be replaced anyway, and well, everything should be able to win something at the end.