To finish our current series of posts on our exploration of the excellent book ‘Range: Why Generalists Triumph in a Specialized World‘ by David Epstein, I noted how the concepts developed about generalist vs specialist also applied in the field of project definition. It takes generalists and a diverse set of viewpoints to test the adequacy of a project definition file and associated estimate.

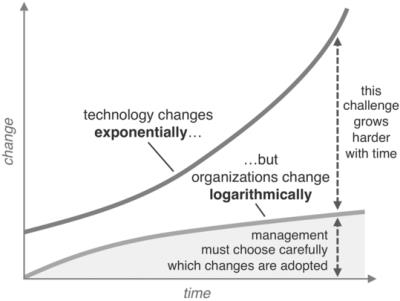

“Bent Flyvbjerg, chair of Major Programme Management at Oxford University’s business school, has shown that around 90 percent of major infrastructure projects worldwide go over budget (by an average of 28 percent) in part because managers focus on the details of their project and become overly optimistic. Project managers can become like Kahneman’s curriculum-building team, which decided that thanks to its roster of experts it would certainly not encounter the same delays as did other groups. Flyvbjerg studied a project to build a tram system in Scotland, in which an outside consulting team actually went through an analogy process akin to what the private equity investors were instructed to do. They ignored specifics of the project at hand and focused on others with structural similarities. The consulting team saw that the project group had made a rigorous analysis using all of the details of the work to be done. And yet, using analogies to separate projects, the consulting team concluded that the cost projection of £ 320 million (more than $ 400 million) was probably a massive underestimate“

“This is a widespread phenomenon. If you’re asked to predict […], the more internal details you learn about any particular scenario […] the more likely you are to say that the scenario you are investigating will occur.”

This is why we observe again and again the immense benefits of having independent reviews of projects by people having a generalist overview and not emotionally involved with the project to get an objective feedback. While this is what we promote, the fact that this review is systemic and performed by generalists is also an essential part of the value delivered. I will highlight it more in the future.