The focus of venture capitalists such as Andreessen Horowitz is on virtual marketplaces. They even follow the top 100 online marketplaces as the hottest ventures around. Those are the companies like Amazon, eBay, Airbnb, Uber and Lyft, Alibaba, Instacart…

That marketplaces or trading ventures are probably the most secure way to riches is well known for a long time (I use often the example of the Californian gold rush of 1849 or the Klondike gold rush – statistically the traders became richer, and in a far more reliable manner, than the prospectors). They are also the most easily scalable as they are not linked to production factors, only to logistics, therefore require relatively less capital to be setup and operated. They earn inter-mediation fees with relatively limited risk compared to the people that do the work.

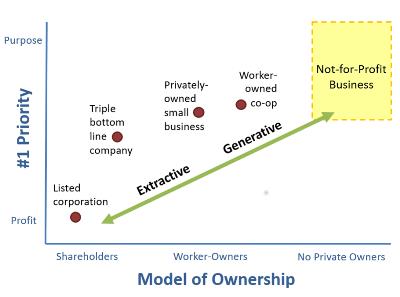

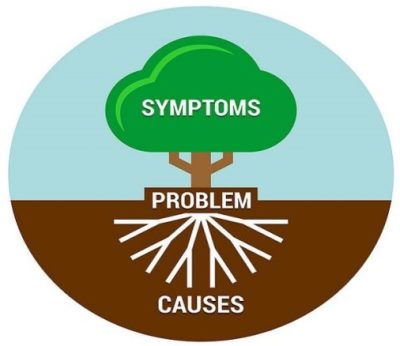

No wonder marketplaces are hot for venture capitalists and investors. It is also probably one of the easiest kind of start-ups to get financed those days. However, the trader should not forget that at the end of the day it is relying on producers and they also need to find their benefit in the arrangement. Sustainable marketplaces need to maintain a fair treatment of producers. It is not quite yet the case in the virtual world with the gig workers, but will come soon.

If you want to launch a start-up, consider marketplaces. Easy to fund, less capitalistic, quicker to scale. Too bad I tend to prefer longer term, concrete innovative producers in my investments!