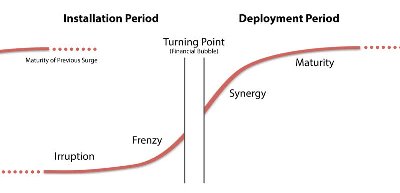

Carlota Perez is a well known economics scholar and her framework to explain major technological disruptions is well quoted. Basically she distinguishes an initial installation phase, followed by a deployment phase. But more importantly, her framework predicts a major crisis between both phases, generally in the form of a financial or stock market crash.

This approach is quite interesting historically and tends to explain some major crashes like the internet-induced crash of 2000, and previous crashes linked to the disruption of certain technologies (from railways to gasoline engines, see the summary of her book ‘Technological Revolutions and Financial Capital’ on Wikipedia). The point is “nothing important happens without crashes“.

Hence, destructive creation due to innovation also means financial crashes. They can’t be avoided because this is the crisis period where the previous technology becomes obsolete and leaves the way open to the new, disruptive technology. There is necessarily a switch in capital allocation and this happens through a financial crisis.

The argument is interesting, and one can wonder whether we may not take it the other way around: is each major financial crisis the reflection of an underlying disruptive technology taking hold, creating a deep transformation of the world?