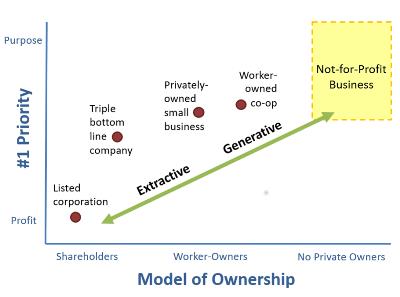

In the very interesting (and recommended) book ‘The systems view of life‘, the work of Marjorie Kelly is mentioned about various ways of owning a company. She opposes extractive and generative ownership.

Her view of ownership design is that five essential patterns work together to achieve either an extractive or a generative design:

- purpose,

- membership,

- governance,

- capital

- and networks.

Extractive ownership has a mainly a financial purpose: maximizing profits. It is actually the classical business organisation that emerges from the classical theory. Generative ownership, however, has a living purpose: creating the conditions for life. It is closer to non-profit organisations and is generally more characteristic of smaller, more human-size organisations.

I find this analysis quite interesting as it creates a distinct framework to analyse the economy and the economic actors. And it is quite true that many smaller organisations correspond more to the generative type, as they contribute to develop living networks without focusing exclusively on profit.

Generative vs extractive ownership is quite a useful distinction.