Quite opposed to our previous post ‘How Social Media Currently Rewards Bad Behavior‘, Seth Godin post ‘Amplify possibility‘ provides a much more positive view on the adjustments that would be required to make social media more positive.

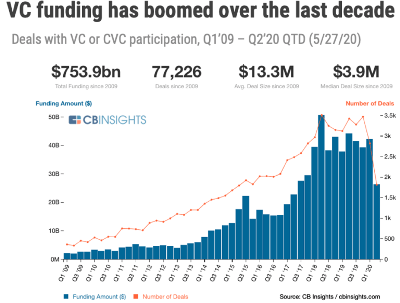

His analysis of the current situation echoes the analysis of many: “The social media companies optimized their algorithms for profit. And profit, they figured, would come from engagement. And engagement, they figured, would come from confounding our instincts and rewarding outrage.”

He uses a metaphor that I find powerful. Many people slow down to watch when there is an accident on the road, but we are almost in social media today at the stage where we create accidents to engage and get the attention of people!

However, according to him, “That’s not how the world actually works” Actual influencers, he argues, behave differently. It is more a long term engagement, a commitment over time, the development of deep relationships and expertise.

Thus it should not be too difficult to tweak the engagement rules of social media to reward those behaviors instead of the ones we see. “Amplify possibility. Dial down the spread of disinformation, trolling and division. Make it almost impossible to get famous at the expense of civilization. Embrace the fact that breaking news doesn’t have to be the rhythm of our days. Reward thoughtfulness and consistency and responsibility.”

I find this approach enticing, although obviously that would require quite a focus change from the major social medias of today, and less seeking of profit and market share. Maybe that could be an idea for a social network competitor?