In this must-read Harvard Business Review article ‘Six Myths About Venture Capitalists‘, Diane Mulcahy shows that Venture Capitalists (VC) don’t really play the role that conventional knowledge would expect.

Diane Mulcahy is also famous for being a Venture Capitalist herself and having written a well-known report (‘We Have Met the Ennemy… and He is Us’ accessible here in pdf)showing that Venture Capitalist’s return on investment is quite abysmal.

So what are those 6 myths?

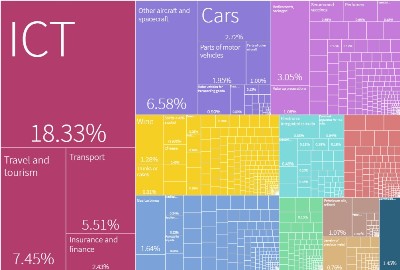

- Venture Capital Is the Primary Source of Start-Up Funding

- VCs Take a Big Risk When They Invest in Your Start-Up

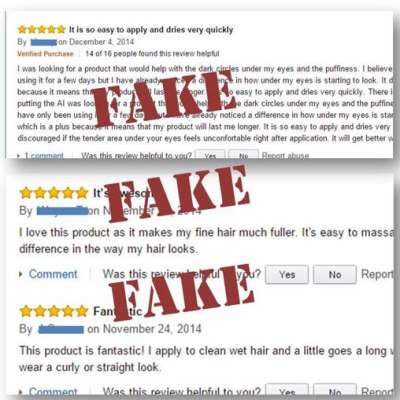

- Most VCs Offer Great Advice and Mentoring

- VCs Generate Spectacular Returns

- In VC, Bigger Is Better

- VCs Are Innovators

Basically it appears that VCs encounter the paradox of being institutions that deal with something very fluid and unstable, startup companies. And obviously their constraints as institutions do not really allow them to provide the kind of support and value that startup would need. And VC does not scale well: it works best as a “cottage industry” – personally I can that ‘craftsmanship’.

The most interesting part is how little VCs actually contribute to the funding of young companies overall – less than 1% apparently. Still they seem to make the US startup scene quite dynamic, but behind the hype, the situations isn’t so rosy.

Venture Capital is only one solution for funding a fast-growing company, and it may not be the best or most adapted. And there’s too much hype and money to make it work as good as it should.