I can only recommend to read this enlightening research paper ‘Bubble or nothing‘, produced by an American Think Tank. It may require some time to read, but I believe it is absolutely worthwhile to understand how the current economic situation differs from the 20th century economic situation – and how therefore, history can only be of limited value in understanding future economic behavior.

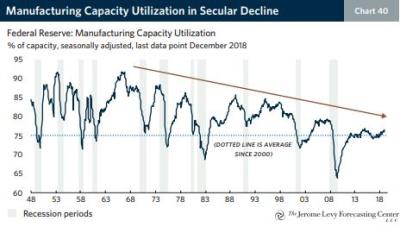

The point is that “The evolution of the economy’s aggregate financial structure [with a much higher value of assets compared to value production] has, over decades, altered the playing field for financial decision makers throughout the economy, increasingly skewing their available options toward higher risks, lower returns, or both.” Basically, the increase in asset value implies low interest rates. Those low interest rates are much below the return rates expected from financial players (such as retirement funds), and this leads them inevitably to take higher risks than they would have in the past.

The author calls the time since the mid-1980s the “era of the Big Balance Sheets”. According to him, this excessive risk-taking behavior explains situations as the one giving way to the 2008 financial crisis, which stemmed from the property market. “Each successive crisis, with more bloated balance sheets to stabilize, was more difficult to resolve and therefore required the government to engineer dramatic new lows in interest rates, heavy fiscal stimulus, and other measures to stabilize economic conditions. The measures eventually overcame recession and chronic weakness, but in doing so they necessarily caused further expansion of balance sheets relative to income.“

This current situation appears to be quite metastable, with excessive risk-taking happening since the early 2010s, and may lead to another hard recession with substantial asset value decrease. Whether this decrease will be temporary or more permanent is still open (previous recessions have not changed the excessive asset value on the long term).

As a summary, “The U.S. economy continues to face a bubble-or-nothing outlook. Participants in the economy and markets will keep increasing their financial risk until the expansion breaks down, and the bigger the balance sheets are relative to income, the more severe the breakdown is likely to be.”

Take some time to read this instructive analysis, as it provides an interesting explanation of the changes in our economy in the last decades.